san antonio sales tax rate 2021

What is the sales tax rate in Bexar County. Ad Find Out Sales Tax Rates For Free.

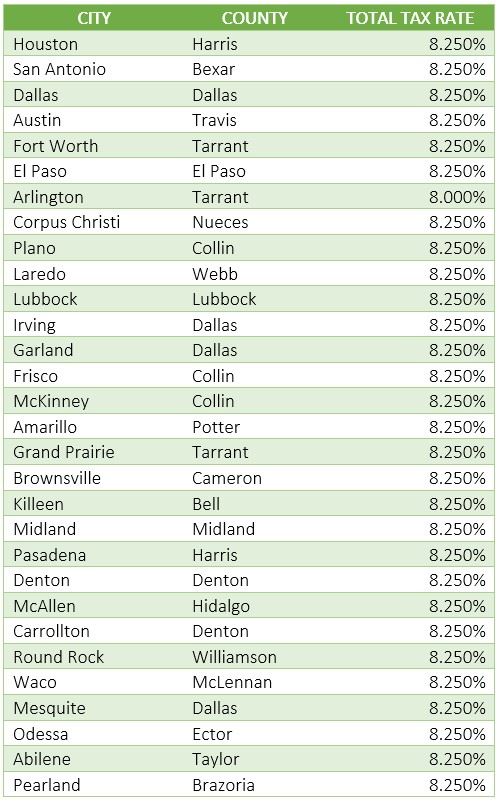

Sales Tax Rates In Major Cities Tax Data Tax Foundation

There is no applicable county tax.

. 0250 San Antonio ATD Advanced Transportation District. San Antonio TX 78283-3966. There is no special rate for New Home.

The Bexar County sales tax rate is 0. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. The Texas state sales tax rate is currently 625.

What is Texas sales tax rate. San Antonios current sales tax rate is 8250 and is distributed as follows. 2021 antonio rate.

The local sales tax rate in San Antonio Florida is 700 as of June 2019. How Does Sales Tax in San Antonio compare to the rest of Texas. 1000 City of San Antonio.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. NOTICE ABOUT 2021 TAX RATES - City of San Antonio 8242021 with changes. 2018 rates included for use while preparing your income tax.

The minimum combined 2022 sales tax rate for San Antonio Texas is. 6 and goes through midnight Sunday Aug. Bexar Co Es Dis No 12.

What is the sales tax rate in San Antonio Texas. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Fast Easy Tax Solutions.

This is the total of state county and city sales tax rates. 0125 dedicated to the City of San Antonio Ready to Work Program. 211 South Flores Street San Antonio TX 78207 Phone.

City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office. The 2021-2022 school year will be starting off differently than the previous year. The San Antonio Sales Tax is collected by.

Counties cities and districts impose their own local taxes. The minimum combined 2022 sales tax rate for Bexar County Texas is 825. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. City sales and use tax codes and rates. 4 rows The current total local sales tax rate in San Antonio TX is 8250.

Rates will vary and will be posted upon arrival. 0500 San Antonio MTA Metropolitan. Did South Dakota v.

SAN ANTONIO The annual Texas tradition of having a tax-free weekend ahead of the new school year continues in 2021. The San Antonio Mta Sales Tax is collected by the merchant on all qualifying sales made within San Antonio Mta. Fill in price either with or without sales tax.

The San Antonio sales tax rate is. The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local sales taxesthe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The December 2020 total local sales tax ratewas also 63750.

View the printable version of city rates PDF. The New Homes tax rate may change depending of the type of purchase. Download city rates XLSX.

The Texas sales tax rate is currently. This rate includes any state county city and local sales taxes. Calculator for Sales Tax in the San Antonio.

The results are rounded to two decimals. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. 2021 low income housing tax creditchodo.

You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. Sales Tax Calculator of New Home for 2021 Every 2021 combined rates mentioned above are the results of Texas state rate 625 the county rate 05 the Texas cities rate 1. US Sales Tax Texas Bexar Sales Tax calculator San Antonio.

The December 2020. The 2018 United States Supreme Court decision in South Dakota v. Method to calculate San Antonio Heights sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

San Antonio NM Sales Tax Rate. San Antonio collects the maximum legal local sales tax. NM Rates Calculator Table.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. The current total local sales tax rate in San Antonio NM is 63750. San Antonio Tax Rate 2021.

This years sales tax holiday begins Friday Aug. This is the total of state and county sales tax rates. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative.

There is base sales tax by Texas. City Sales and Use Tax. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services.

Monday - Friday 745 am - 430 pm Central Time. 625 percent of sales price minus any trade-in allowance. Is San Antonio tax free.

Texas Comptroller of Public Accounts. 1RWLFH ERXW 7D 5DWHV. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

2020 rates included for use while preparing your income tax deduction. Sales and Use Tax. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

Does San Antonio have income tax. The San Antonio Texas general sales tax. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax.

The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

The County sales tax rate is. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc.

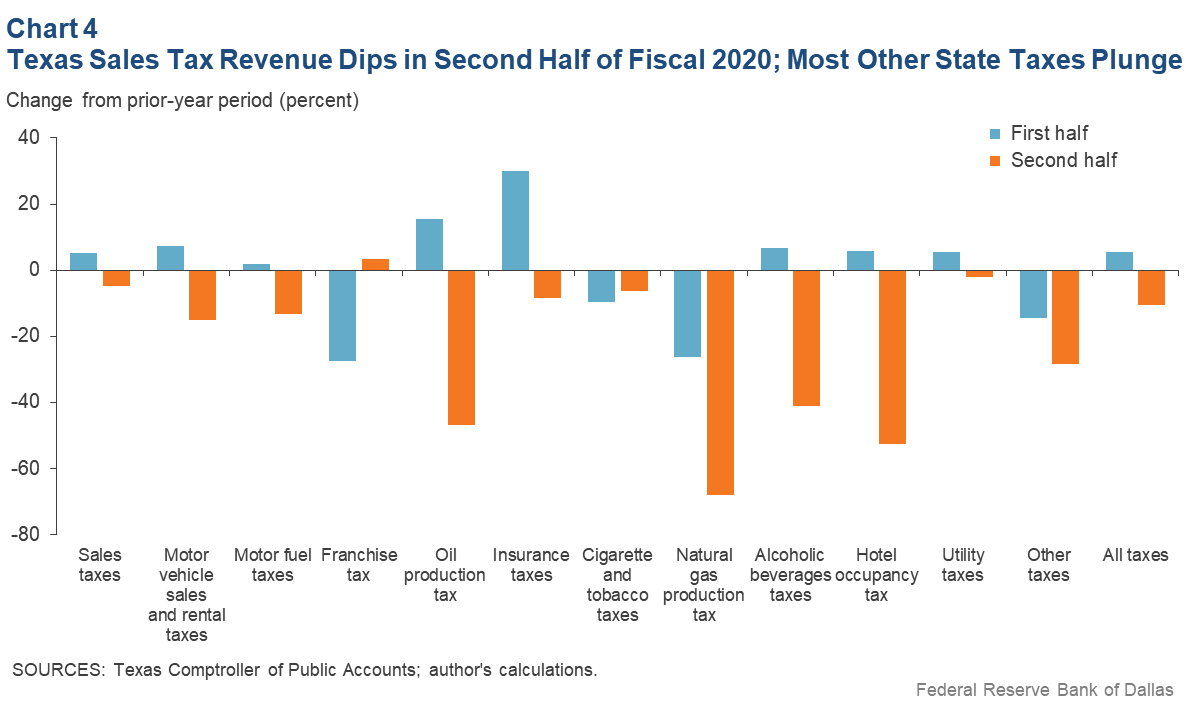

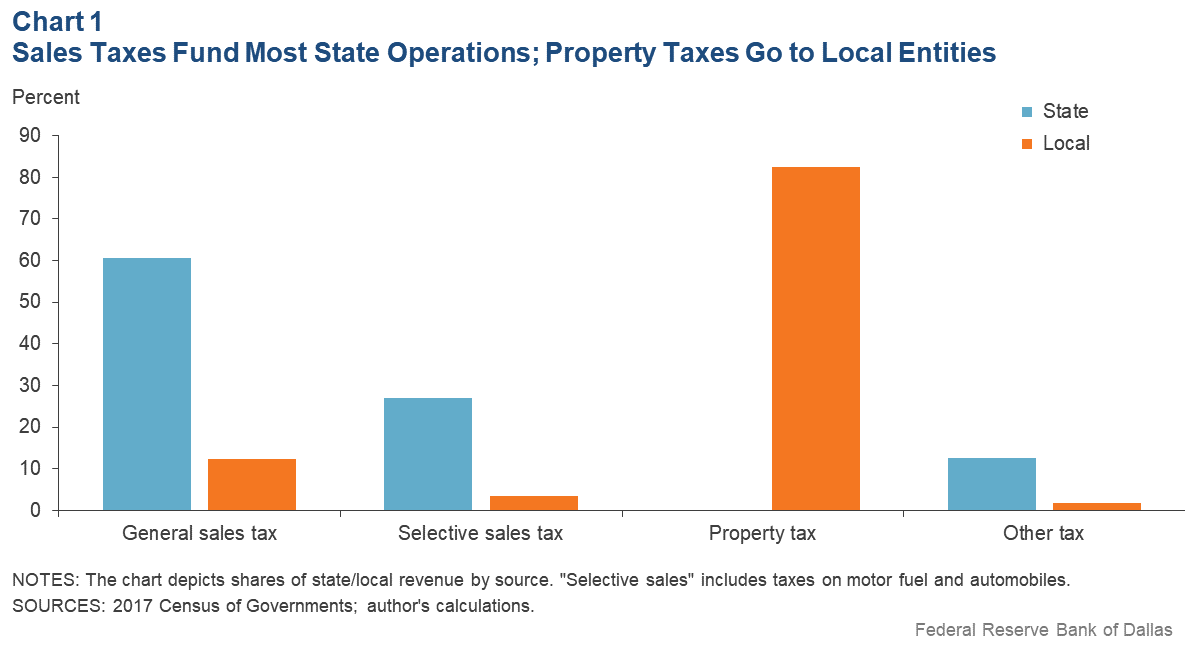

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

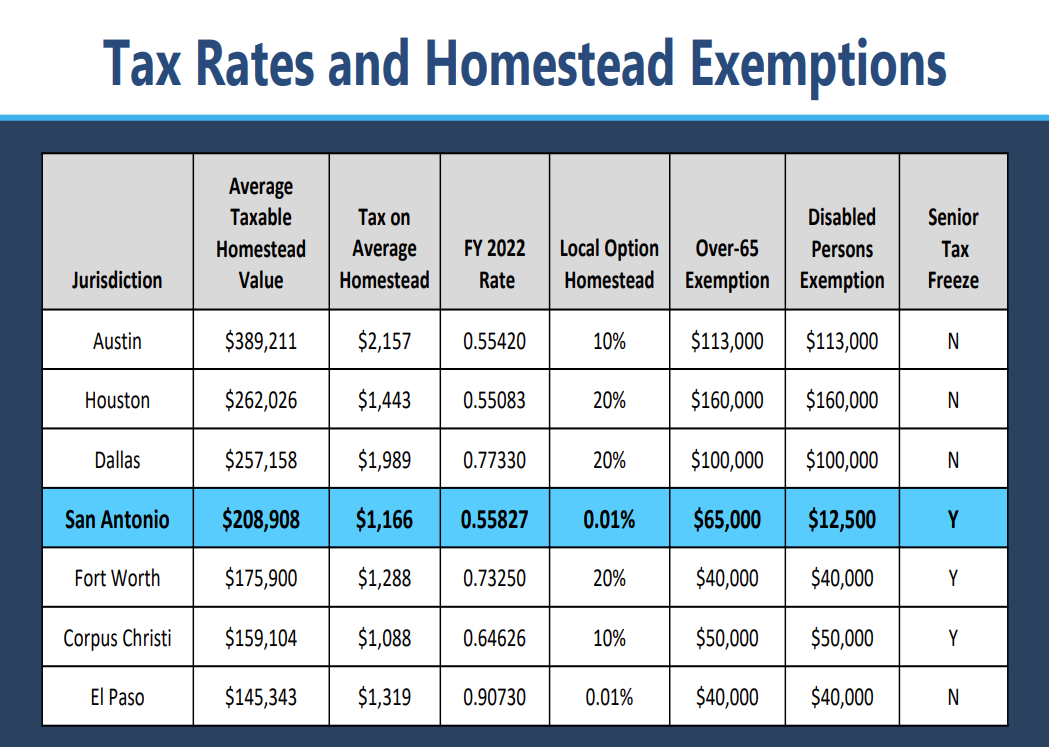

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Laura Elizabeth Mayes Lauraelizabethm Twitter

How To Get Tax Refund In Usa As Tourist For Shopping 2022

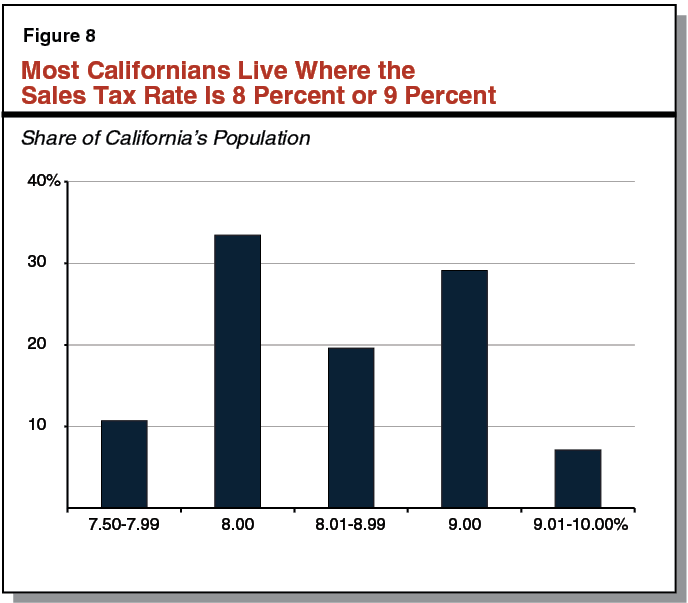

Understanding California S Sales Tax

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

States Are Imposing A Netflix And Spotify Tax To Raise Money

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sales Tax Rates By City County 2022

Tax Proposals Comparisons And The Economy Tax Foundation

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Sales Tax By State Is Saas Taxable Taxjar

Understanding California S Sales Tax

2021 Housing Forecast In 2021 Real Estate Marketing Housing Market Real Estate Infographic